With easy norms and regulations, a joint property development agreement is becoming a common sight in the Indian real estate ecosystem. The Indian Government has also revised the tax on Joint Development Agreements (JDA) to facilitate rapid growth in order to provide affordable housing options to all sections of the society. But are you aware of what a Joint Development Agreement is and what is the process to make a contract of Joint Agreement? Let’s find out:

A JDA is an official contract between the landowner and builder describing in detail how the construction will take place. As the name suggests, this Agreement means an accord to develop and construct based on fixed guidelines and share the properties accordingly. The Joint Development Agreement between the landowner and builder defines the ownership rights of the property and the guidelines for the construction of the property. Through this arrangement, the landowner provides their land to the builder for development under a fixed contract. The builder then carries out the construction based on the guidelines of the JDA. Based on the terms and conditions of the JDA between the landowner and the builder, the profit shares will be divided.

A Joint Development Agreement (JDA) is a contract between a landowner and a developer to develop a property. In a JDA, the developer agrees to provide various services, and the landowner agrees to provide the land for development. Here are some of the things the developer agrees to provide in a JDA:

Quality Service Guarantee Or Painting Free Unbeatable Price 5-Star Rated Partner! 2200+ Shades! Top Quality Paint Free Cancellation!

There are different forms of Joint Development Arrangement (JDA) that can be used for real estate projects. Some of the common forms of JDA are:

1. Revenue Sharing Model: In this model, the landowner and the developer share the revenue or profits from the project as agreed in the JDA.

2. Built-up Area Model: In this model, the landowner receives a built-up area in the project in proportion to the land contributed, while the developer gets the remaining built-up area for sale.

3. Saleable Area Model: In this model, the landowner gets a share of the saleable area in the project in proportion to the land contributed, while the developer gets the remaining saleable area for sale.

JDA Registration has emerged as a common method in India’s real estate these days. It’s due to the fact that people are getting more aware about delegating work and earning. With JDA, the owner of high-potential land can earn through it without necessarily having the know-how of construction. Joint Development Agreements have facilitated a market where financial limitation or the lack of knowledge cannot stop a landowner from utilising their land’s potential. It has emerged beneficial for large real estate developers and corporate builders who have the finances but lack prime locations due to the unavailability of land parcels.

While both Joint Development Agreements (JDA) and Joint Ventures (JV) involve collaboration between a landowner and a developer, there are some key differences between the two. Here's a quick rundown:

A Joint Development Agreement (JDA) is a complex legal document that requires careful consideration before signing. Here are some things to keep in mind with regard to a JDA:

Through a JDA, the Landowner transfers their development rights and allows construction on their land, and the developer, in return, constructs the building on the owner’s land. It is now up to the Landowner to decide whether to keep their share of flats for personal use or sell their share to the buyers. This arrangement can be classified into:

It still remains debatable whether the Joint Development Agreement comes under the slabs of GST or not. Since the transfer of development rights is similar to the case of the sale of immovable property, the government wants to keep it under the slabs of GST. Service tax on JDA is to be paid by the builder.

Currently, GST is applicable after the supply of the development rights. It means when the landowner transfers their ownership rights to the builder, the responsibility to pay the GST charges is shifted to the builder through the Reverse Charge Mechanism (RCM). Hence, the landowner is not required to pay any GST on a JDA.

However, if the landowner sells their share of the flats and receives a considerable amount from prospective buyers, they are liable to pay GST and other tax on the JJDA. JDA GST charges have been revised based on CBDTs latest circular on JDA taxation.

The Central Board of Direct Taxes introduced section 45(A) through the Finance Acts of 2017 which stated:

[(5A) Notwithstanding anything contained in sub-section (1), where the capital gain arises to an assessee, being an individual or a Hindu undivided family, from the transfer of a capital asset, being land or building or both, under a specified agreement, the capital gains shall be chargeable to income-tax as income of the previous year in which the certificate of completion for the whole or part of the project is issued by the competent authority; and for the purposes of section 48, the stamp duty value, on the date of issue of the said certificate, of his share, being land or building or both in the project, as increased by the consideration received in cash, if any, shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of the capital asset :

Provided that the provisions of this sub-section shall not apply where the assessee transfers his share in the project on or before the date of issue of the said certificate of completion, and the capital gains shall be deemed to be the income of the previous year in which such transfer takes place and the provisions of this Act, other than the provisions of this sub-section, shall apply for the purpose of determination of the full value of the consideration received or accruing as a result of such transfer.

This was the latest GST update on the treatment of Joint Development Agreements.

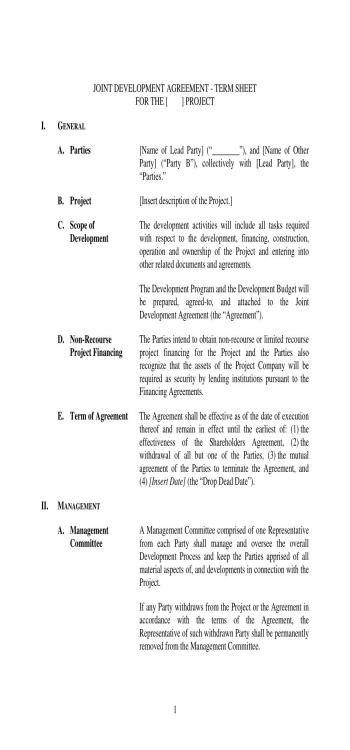

Looking for a joint venture agreement format for the development of land? Here is the correct format for a sample Joint Development Agreement if you are planning to execute one:

Drafting a Joint Development Agreement can be a complicated process, and there are several issues to consider, including:

A Joint Development Agreement between the landowner and a builder offers a lot of benefits to both parties. A JDA offers clear cut instructions to avoid disagreements and disputes. Literal to the definition, Joint Development Agreements are long term commitments and should be considered carefully before execution. Any discrepancies in the guidelines of the JDA can lead to disagreements and disputes between the parties. If you have any more queries around Joint Development Agreement in India, reach out to the legal experts at NoBroker and get all your queries answered. Comment your problem and we will reach out to you.

Ans. Joint Development Agreement Registration has emerged as a common method in India’s real estate these days. A Joint Development Agreement between the landowner and a builder defines the ownership rights of the property and the guidelines for the construction of the property.

Q2. What are the disadvantages of a Joint Development Agreement?Ans. The biggest disadvantage of a Joint Development Agreement is the disputes and disagreements that can arise between the parties concerned over time. The process involves very high capital and requires time as well.

Q3. What are the Joint Development Agreement Stamp Duty Charges?Ans. Stamp Duty Charges Depends based on the state in which the property is located. You can check with the local land registration department.

Q4. What is the definition of a Joint Development Agreement?Ans. A legal arrangement between a landowner and builder, where the landowner contributes the land parcel and the builder constructs the property based on the decided guidelines is called a Joint Development Agreement.

Q5. Is it necessary to get a Joint Development Agreement to be registered?Ans. Yes, all Joint Development Agreements have to be registered at the

Sub-Registrar office.