The banking industry requires a detail-oriented mindset with compliance as a top concern. You shine in that role by overseeing client accounts, monitoring transactions, and providing excellent customer service.

Are your banking resume and cover letter helping you connect with hiring managers to show you’re right for the job?

When banks are looking for skilled employees, they’ll perform detailed reviews to ensure they bring in the most qualified applicants for interviews. To ensure you stand out, use our banking cover letter examples as templates, or leverage the power of our free cover letter builder to help display your abilities successfully.

USE THIS TEMPLATE

123 Fictional Avenue

Austin, TX 76208

(123) 456-7890

November 5, 2023

Zoey Mitchell

Citibank

123 Fictional Lane

Oakland, CA 94601

Dear Mr. Mitchell:

Having long admired Citibank’s commitment to precision and customer service excellence, I’m thrilled at the opportunity to contribute to your mission of delivering exceptional banking experiences that serve clients and promote financial success. I share your goal of providing reliable and accurate financial services to individuals globally. My valuable experience in this field can help enhance customer satisfaction, streamline banking procedures, and foster stronger client relationships as your bank teller.

As an operations associate at 1st United Credit Union, I handled, on average, $267,124 in cash transactions daily. This task necessitated meticulous cash management and record keeping, aiding a 24% reduction in transaction anomalies.

With a penchant for technology integration, I was instrumental in implementing Jack Henry Check processing software at First Republic Bank. Adopting this systematic check-processing tool optimized our transaction processing correctness by 32% and decreased check fraud occurrences by 17%. Furthermore, at First Republic, I strategized an efficient record-keeping system that increased record retrieval speed by 22%.

Grasping the criticality of trust in the banking industry, I tread beyond my role-given responsibilities to ensure transparency, accuracy, and respectful collaboration. It would be an honor to champion these values as a bank teller at Citibank, and I’m eager to share more about how my expertise will beef up the operational excellence of your Oakland team. Thank you.

Enclosures:

Resume

Application

2 letters of recommendation

Academic transcript

Level up your

cover letter game

Relax! We’ll do the heavy lifting to write your cover letter in seconds.

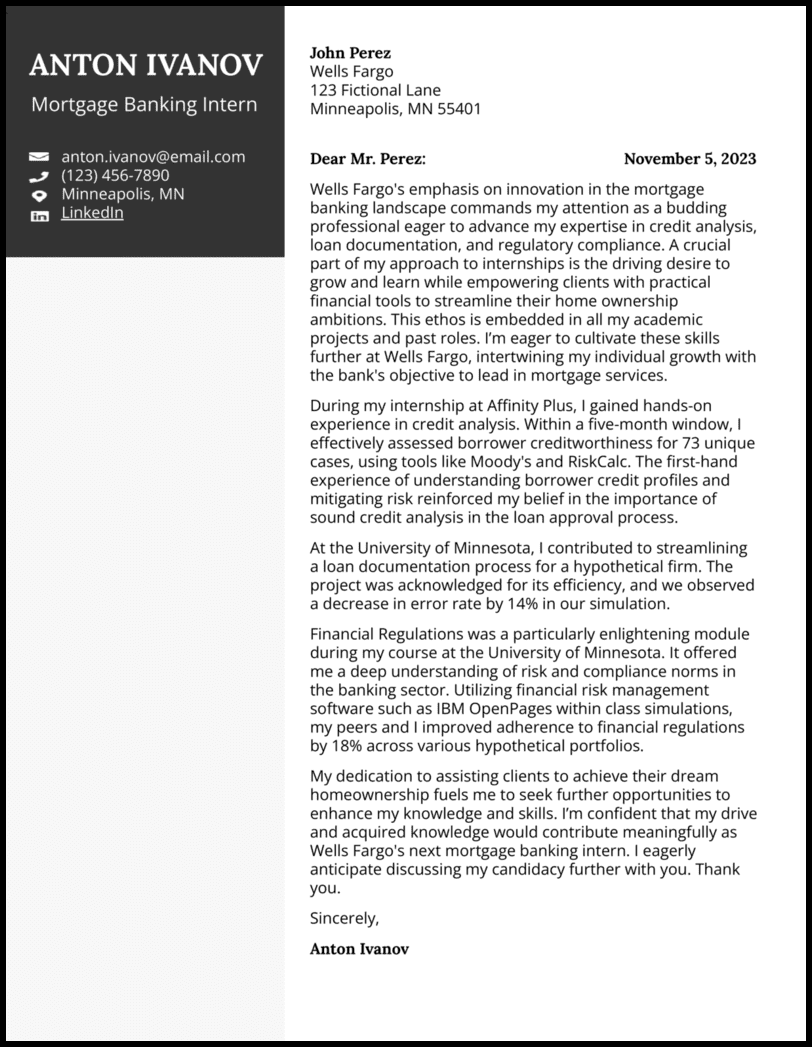

USE THIS TEMPLATE

123 Fictional Avenue

Minneapolis, MN 55401

(123) 456-7890

November 5, 2023

John Perez

Wells Fargo

123 Fictional Lane

Minneapolis, MN 55401

Wells Fargo’s emphasis on innovation in the mortgage banking landscape commands my attention as a budding professional eager to advance my expertise in credit analysis, loan documentation, and regulatory compliance. A crucial part of my approach to internships is the driving desire to grow and learn while empowering clients with practical financial tools to streamline their home ownership ambitions. This ethos is embedded in all my academic projects and past roles. I’m eager to cultivate these skills further at Wells Fargo, intertwining my individual growth with the bank’s objective to lead in mortgage services.

During my internship at Affinity Plus, I gained hands-on experience in credit analysis. Within a five-month window, I effectively assessed borrower creditworthiness for 73 unique cases, using tools like Moody’s and RiskCalc. The first-hand experience of understanding borrower credit profiles and mitigating risk reinforced my belief in the importance of sound credit analysis in the loan approval process.

At the University of Minnesota, I contributed to streamlining a loan documentation process for a hypothetical firm. The project was acknowledged for its efficiency, and we observed a decrease in error rate by 14% in our simulation.

Financial Regulations was a particularly enlightening module during my course at the University of Minnesota. It offered me a deep understanding of risk and compliance norms in the banking sector. Utilizing financial risk management software such as IBM OpenPages within class simulations, my peers and I improved adherence to financial regulations by 18% across various hypothetical portfolios.

My dedication to assisting clients to achieve their dream homeownership fuels me to seek

further opportunities to enhance my knowledge and skills. I’m confident that my drive and acquired knowledge would contribute meaningfully as Wells Fargo’s next mortgage banking intern. I eagerly anticipate discussing my candidacy further with you. Thank you.

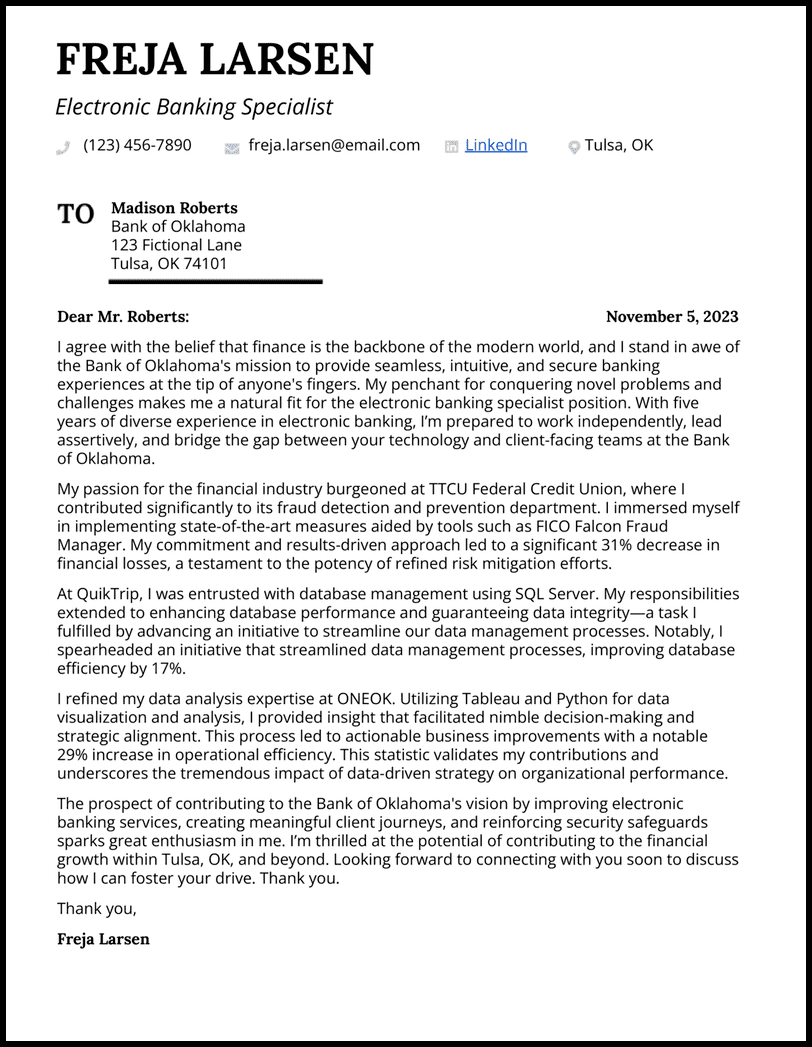

USE THIS TEMPLATE

123 Fictional Avenue

Tulsa, OK 74101

(123) 456-7890

November 5, 2023

Madison Roberts

Bank of Oklahoma

123 Fictional Lane

Tulsa, OK 74101

Dear Mr. Roberts

I agree with the belief that finance is the backbone of the modern world, and I stand in awe of the Bank of Oklahoma’s mission to provide seamless, intuitive, and secure banking experiences at the tip of anyone’s fingers. My penchant for conquering novel problems and challenges makes me a natural fit for the electronic banking specialist position. With five years of diverse experience in electronic banking, I’m prepared to work independently, lead assertively, and bridge the gap between your technology and client-facing teams at the Bank of Oklahoma.

My passion for the financial industry burgeoned at TTCU Federal Credit Union, where I contributed significantly to its fraud detection and prevention department. I immersed myself in implementing state-of-the-art measures aided by tools such as FICO Falcon Fraud Manager. My commitment and results-driven approach led to a significant 31% decrease in financial losses, a testament to the potency of refined risk mitigation efforts.

At QuikTrip, I was entrusted with database management using SQL Server. My responsibilities extended to enhancing database performance and guaranteeing data integrity—a task I fulfilled by advancing an initiative to streamline our data management processes. Notably, I spearheaded an initiative that streamlined data management processes, improving database efficiency by 17%.

I refined my data analysis expertise at ONEOK. Utilizing Tableau and Python for data visualization and analysis, I provided insight that facilitated nimble decision-making and strategic alignment. This process led to actionable business improvements with a notable 29% increase in operational efficiency. This statistic validates my contributions and

underscores the tremendous impact of data-driven strategy on organizational performance.

The prospect of contributing to the Bank of Oklahoma’s vision by improving electronic banking services, creating meaningful client journeys, and reinforcing security safeguards sparks great enthusiasm in me. I’m thrilled at the potential of contributing to the financial growth within Tulsa, OK, and beyond. Looking forward to connecting with you soon to discuss how I can foster your drive. Thank you.

USE THIS TEMPLATE

123 Fictional Avenue

New York, NY 10005

(123) 456-7890

Grace Hill

Deutsche Bank

123 Fictional Lane

New York, NY 10005

A fervent desire to devise cutting-edge financial strategies propels me toward a position on Deutsche Bank’s vibrant corporate banking team. The esteemed record of Deutsche Bank in forward-thinking and placing clients at the forefront resonates with my professional goals. Analyzing intricate financial environments and a solid background in fostering relationships, I stand poised to enhance your team’s capabilities.

At Bank of America, supervisory responsibilities for teller operations fell under my purview. I meticulously processed transactions that often summed up to $138,000+ daily, maintaining unwavering accuracy. A focus on maximizing teller team performance led to the honing of customer satisfaction, enhanced sales techniques, and strict adherence to regulatory practices, all crucial for a corporate banker.

My initiative at Popular Bank bore fruit as sales surged by 12% within a single quarter, a testament to my knack for engaging customers and intelligently recommending products. The seamless initiation of 79 new accounts reflects my adeptness at spotting and nurturing potential business opportunities. It’s this acute understanding of client needs and delivery of bespoke financial solutions that I’m excited to bring to Deutsche Bank to fuel further growth.

At HSBC, the challenges of problem-solving and precise attention to detail were my daily companions, ensuring clients’ needs were met seamlessly. Partnering with account managers and loan officers, I facilitated top-notch service, managed cash reserves and ATMs without error, and meticulously organized transaction documentation for efficient processing. My demonstrated proficiency in credit evaluations, financial proposals, and credit risk oversight will serve well in the intricate landscape of corporate banking.

The opportunity to drive growth and innovation at Deutsche Bank ignites a sense of enthusiasm in me. I’m deeply appreciative of your consideration of my candidacy and am looking forward to elaborating on the ways my experience, skills, and qualifications will resonate with the unique demands of the corporate banker role.

Enclosures:

Resume

Transcript

Letter of recommendation

USE THIS TEMPLATE

123 Fictional Avenue

Washington, DC 20433

(123) 456-7890

Jackson Rodriguez

The World Bank

123 Fictional Lane

Washington, DC 20433

Dear Mr. Rodriguez:

Driven by a fervent zeal for global finance and sustainable development, the role of investment officer at the World Bank appears to be a perfect arena for me to apply my deep well of expertise. Having navigated the complex world of investment banking with a keen focus on nurturing economic growth in emerging markets, my career trajectory seems to be in harmonious alignment with the ambitions and aspirations of your esteemed organization.

During my tenure at Wells Fargo, the complex labyrinth of teller operations was my battlefield, where I led the charge in implementing cutting-edge cash management techniques and tackling high-stakes customer service dilemmas. Tasked with the reconciliation and processing of daily transactions that sometimes soared to $223K, my initiatives to refine operational processes and foster staff development boosted efficiency by 26%.

At United Bank, my leadership catalyzed a team of tellers to consistently surpass our upselling goals, achieving an impressive 94% completion rate each quarter. This feat underscored my prowess in negotiation and deal structuring, skills directly transferable to the elaboration and negotiation of investment agreements and the crafting of proposals for the World Bank.

While at JPMorgan Chase, my role entailed rigorous management of client accounts, where precision and operational efficacy were paramount. My strategies yielded an 18% increase in portfolio returns over a year, underlining my aptitude for portfolio management. This experience is invaluable for overseeing the Bank’s investments, ensuring robust governance, and optimizing returns.

To conclude, my journey through financial operations, customer service, and leadership landscapes has sculpted me into an ideal candidate for the investment officer position at the World Bank. Fueled by a dedication to sustainable investing, I’m keen to explore how my array of skills and experiences will resonate with the foundational goals of the World Bank. I appreciate your consideration and look forward to adding value to your team.

Enclosures:

Resume

Transcript

Letter of recommendation

While all banks have standardized processes to ensure compliance, that doesn’t mean that each one won’t have unique qualifications they’re looking for applicants to possess.

For instance, one bank may be seeking a reconciliation expert, whereas another may be looking for a customer-centric teller who can create a great experience for everyone who walks through their doors. You’ll want to customize each cover letter you submit based on the job description.

![]()

When someone walks into the bank, you know the importance of creating a friendly atmosphere since every customer makes a first impression quickly. The same is true when bank hiring managers are reviewing cover letters.

The first step to stand out is greeting a specific hiring manager by name if it’s listed in the job description or on the bank’s website. It’s the same as connecting with customers by learning their names before discussing investment opportunities.

Then, once you get into the first paragraph, you’ll want to show how you connect with the bank’s mission and where your skills fit in. For instance, how you want to use your knowledge of debt consolidation and index funds to help customers make smart financial decisions.

The intro below doesn’t make enough of a connection since it lacks key details about the applicant’s specific mortgage banking skills and the company’s mission.

Hello Mr. Halbert,

Upon seeing the mortgage banking job you have available, I immediately thought this sounded like a great role for my skills. This sounds like a great company to work for, and I would be excited to join your team.

The opener below makes a better connection since the applicant showcases an evident passion for Citibank’s commitment to customer service excellence and exceptional banking experiences.

Dear Mr. Mitchell,

Having long admired Citibank’s commitment to precision and customer service excellence, I’m thrilled at the opportunity to contribute to your mission of delivering exceptional banking experiences that serve clients and promote financial success. I share your goal of providing reliable and accurate financial services to individuals globally. My valuable experience in this field can help enhance customer satisfaction, streamline banking procedures, and foster stronger client relationships as your bank teller.

![]()

As you get into the body section when writing a cover letter, it’s time to think about how you can share more details about the customer service and financial solutions skills you highlighted in the opening paragraph.

A great way to illustrate your impact as a banker is by using metrics since every financial solution requires data to make accurate decisions. Depending on your role in the bank’s success, everything from customer satisfaction rates to loan-to-asset ratios could work well in this section.

Additionally, if you’re applying to a role like a mortgage banker or investment banker that requires some education, you could also explain how your degree in finance or related fields has equipped you to succeed.

As an operations associate at 1st United Credit Union, I handled, on average, $267,124 in cash transactions daily. This task necessitated meticulous cash management and record keeping, aiding a 24% reduction in transaction anomalies.

![]()

As you begin the closing paragraph of your banking cover letter, you’ll want to relate back to some of the key financial solutions skills and your connection to the bank’s mission. For example, your passion for the bank’s commitment to excellence and how you want to use your financial analysis skills to provide accurate service to every customer.

After that, it’s a good idea to thank the bank’s hiring manager for their time and end with a light call to action. It’s similar to thanking customers for banking with you and saying you look forward to seeing them again to increase customer retention rates.

The closer below lacks impactfulness since the applicant doesn’t use a call to action or reference the bank’s mission.

Overall, I believe my experience as a mortgage banker will be a valuable addition to your team. Thank you for considering my qualifications.

The closer below makes a much better impact by referencing the applicant’s passion for helping clients achieve their dream of homeownership.

My dedication to assisting clients to achieve their dream of homeownership fuels me to seek further opportunities to enhance my knowledge and skills. I’m confident that my drive and acquired knowledge would contribute meaningfully as Wells Fargo’s next mortgage banking intern. I eagerly anticipate discussing my candidacy further with you. Thank you.

How do I choose the right banking skills to write about?Reviewing the job description and understanding the bank’s needs is the best way to include job skills that stand out. For instance, if the position requires cross-selling, you could write about previous experiences cross-selling credit cards or business banking solutions.

What’s the best tone for banking cover letters?The best way to optimize the tone you write in is by reviewing the job description and trying to match the tone each bank uses. For instance, if a bank uses a formal and logical tone, matching that shows how you’ll fit in with their professional and knowledgeable work culture.

What if I don’t have banking work experience?If you haven’t worked in banking before, you could emphasize translatable skills like other jobs involving customer service or data entry. Or you could emphasize relevant education like a bachelor’s degree in finance that equipped you with the necessary skills.